In a well documented trend, people became more attracted to living in less condensed environments, such as suburban or coastal communities. Migration to these areas and a shortage in supply to meet demand meant there was an immediate impact on rental affordability for many different groups of the population.

Another trend accelerated by the pandemic, flexible working, meant that a larger proportion of people were no longer tied to a physical area due to employment. Further fuelling movement and a shortage in supply.

Fast forward to 2022, and with growing pressures on the cost of living, rent has continued to increase, but not proportionally for all groups.

In this article, we examine Australian rental data since the beginning of the pandemic, showcase trends in the current landscape for renters and offer advice for organisations.

Post-pandemic migration out of the inner-cities

Before the pandemic, we knew many things about the demographic make-up of the Australian population, due to the work Experian has done to analyse it through its consumer categorisation platform, Mosaic. For example, older age groups were proportionally more likely to live in more rural or coastal areas. Younger generations, proportionally more likely to live in inner cities.

And interestingly, the coastal and rural areas have seen the sharpest increases in rental rates since 2019.

Young people in inner cities, who traditionally bear the brunt of a competitive rental market, have had the lowest increase in rental rates of any demographic group.

A reduced supply in 2021 was a contributing factor in driving prices higher. Thankfully for many, the supply of rental properties is getting back to pre-Covid levels or even exceeding it. For example, the supply of properties targeted at young professionals and students are on course to be the highest for the past 5 years. Whereas properties for families in 2022 will likely continue to be below pre-Covid supply levels.

Looking ahead, prices are expected to continue to increase for many due to a number of factors, such as the return of services like Airbnb, more people on long-term international travel, and landlords selling their properties in order to benefit from high property prices.

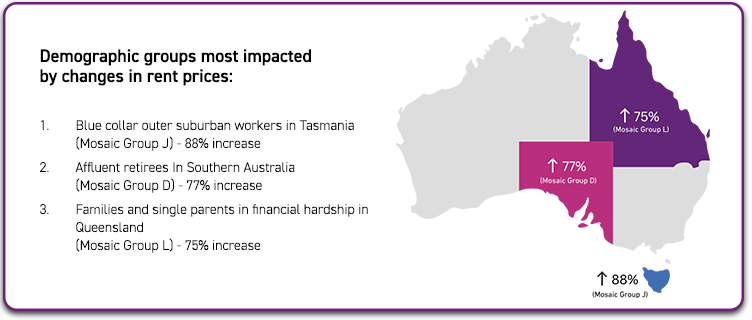

Less-populous states drive largest increases in rent

Since 2019, it is no coincidence to see the largest increases in average rent prices occurring in the less-populous states as people prioritise open spaces and less condensed housing. Rent rates in Tasmania, for example, have increased the most, rising 40% since 2019, climbing from $350 per week to $493 per week. The second largest increase was in Western Australia (38%), followed by Queensland with an increase of 34%. The two most populous states experienced the lowest increase, with Victoria at just a 10% increase and New South Wales at 17%.

The most expensive state for renters is still New South Wales, despite it growing less quickly, with average weekly rent at $629 – $114 higher on average than Victoria. Southern Australia has the lowest average weekly rental rate, at $459.

And yet, New South Wales has seen unprecedented rent increases in coastal communities. The average increase on the coast was 42%, considerably higher than the average of 17% across the state as a whole. Victoria saw an even larger average increase of rent in coastal communities (51% vs. 10%) and there was also a sharp difference in Western Australia (60% vs. 37%).

Sharper increases for older population in rural and coastal areas

As we can see from the rental data analysed by location (in this case by State), there was a smaller increase in major cities (i.e. Sydney, Melbourne) compared to more regional areas. This view is reflected in the different demographic groups across Australia.

The smallest change (10% increase) was across young, successful, career-driven professionals living in central city areas with high income and no children (Mosaic Group C).

The biggest change (44% increase) was across rural communities who work in agriculture, living on large plots of land far from main roads and main towns (Mosaic Group N). Average rents increased from $337 to $486 per week, however the majority of that change occurred since 2021.

Part of the increase is as a result of supply. For our young professionals (Mosaic Group C) there has been a consistent volume of rental properties year-on-year since the beginning of the pandemic. For our agriculture workers from rural communities (Mosaic Group N) it has been a very different story. They saw a 29% drop in rental properties in 2021 alone, and are only just seeing the numbers start to rise again as we progress through 2022.

The highest spending demographic group, paying $1,061 per week on average on rented accommodation, was middle-aged families with significant assets and income (Mosaic Group A). This makes sense as they have built up larger volumes of assets and can manage fluctuations in rental affordability. The lowest spending demographic, paying $481 per week on average, was younger, blue-collar workers renting far from city centres, with below average income (Mosaic Group H).

When we really drill down into demographics by State, we can see some groups hugely impacted by changes in rent prices. For example, blue collar, outer suburban workers in Tasmania (Mosaic Group J), saw an average rent increase of 88%, from $256 in 2019 to $482 in 2022.

What does this mean for your organisation?

Some of the stats that our research has revealed have been quite stark. A near double increase in rental rates for families facing financial hardship in some areas, makes for depressing reading.

And yet, these trends also offer organisations opportunities;

- Make more intelligent financial impact assessments – using tools like Mosaic, you can understand your consumers in immense detail. You can identify financial trends for particular groups, and make decisions based on these insights.

- Growth in movers offers opportunity to home retail and insurance providers – People moving house, furnishing and insuring their new properties provides a good opportunity.

- Young professionals with high disposable income – Lack of rent growth in inner-city communities has left young professionals with greater sums of disposable income that could be used for holidays or eating out.

- As offices open up and welcome back workers, tenants will continue to move back to metro areas to live closer to workplaces – an important consideration for utility and telcos for retention and acquisition.

- High rent trends will mean some groups won’t have the spending power as was previously the case, especially rural people working in agriculture. For some it moves them further into financial hardship so there’s a greater need to be proactive around hardship programs for these segments.

Talk to Experian

If you would like to understand this research in more detail, or would like to discuss how deep consumer classification could help you make smarter decisions, then please get in touch today.