With borrowers more digitally and financially savvy and the lending scene facing greater challenges, how are lenders keeping up?

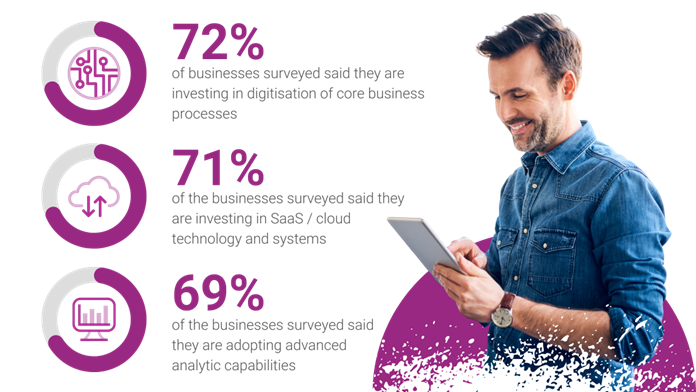

Risk experts we surveyed pointed to digital transformation as the best way to manage core priorities and our research with Forrester and published in the 2022 Business and Consumer Insight Report, revealed 53% of businesses are investing more of their budget into the digitisation.

Digital innovation is a critical enabler allowing lenders to make personalised customer management decisions at scale. Looking ahead to the remainder of 2023, lenders are focussed on improving automation and increasing the speed of processes, as well as the accuracy of decisions, while continuing to develop better data practises for the evolving market.

With increasing interest rates, what safeguards do providers have in place to best manage serviceability, whether for new customers or those refinancing their existing loans?

The priority for lenders is to understand current and future consumer affordability. It’s clear this is directly impacted by the current economic situation, so all lending decisions need to be made with clarity of an individual’s unique financial situation – both now and in the future.

As a minimum, lenders would be adjusting their essential expenditure assumptions to consider things like known energy price increases, food inflation and higher fuel costs for example, though this isn’t a one-off exercise. It’s also important to factor in regular reviews based on the latest available data and forecasts whenever reviewing affordability strategies. To maintain sustainable and affordable lending, lenders would need to keep the following questions in mind:

- Is the right data captured directly from the consumer?

- Are we using the best and most accurate data available across both income and expenditure calculations?

- Does our calculation take account of known or expected changes to a consumer’s income or expenditure?

This is where affordability solutions like Experian’s Affordability Check come into play. Powered by Open Banking, it uses a wealth of data to bring together all of the components required for lenders to quickly and easily assess an individual’s affordability through their relationship with them:

- Data access – Delivering bureau data and account transactional data using secure APIs, giving lenders a holistic view of a person’s ability to afford credit

- Data analysis – Our automated categorisation engine takes raw data and in real-time splits this information into income and expenditure categories making it easier for lenders to consume into their processes

- Data supply – Using secure APIs the data is supplied to the lender enabling them to offer a seamless personalised customer experience

From the 2022 Business and Consumer Insight Report we know that more than half of businesses (53%) surveyed identify Open Banking as an exciting opportunity to improve the services offered to customers, refine creditworthiness checks and identify customers showing signs of financial stress. Additionally it’s creating huge opportunities, with 48% of businesses surveyed already seeing significant value from the Open Banking Projects.

How will Open Banking further change consumer borrowing behaviours?

Regardless of whether people are in the industry or not, familiarity with Open Data and Open Banking remains relatively low. Our research in the 2022 Business and Consumer Insight Report has shown that many Australian consumers don’t understand how their data is used by businesses and around half feel they aren’t receiving adequate protection:

It’s vital that businesses recognise and address these concerns, to build trust and confidence with consumers so they are willing to share their data. Even though some consumers have reservations about how their data is being used under the Consumer Data Right framework, many are willing to share their data provided there is a clear value exchange. For example, of the 22% of Australian consumers who are unlikely to share their transactional data, they would be willing to change their mind for the right reason:

The latest figures show that in the UK 6 million consumers have already benefited from Open Banking. They found that 64% of consumers said that using Open Banking savings apps increased their total level of saving and helped them develop regular savings habits, while using money management apps improved their understanding of their finances. Experian UK’s Open Data Platform currently processes 91m data transactions a month.

Our UK business found that of the lenders surveyed that leverage Open Banking, 67% were using it to understand financial stress and consumer vulnerabilities in onboarding or delinquency and 28% were using it to personalise collection strategies

Hardship solutions are more relevant than ever. How can digital technology be leveraged to keep lenders and borrowers protected?

Many Australian households are under increasing pressure as they try to manage the financial impact of interest rate rises, inflation and cost of living increases. This is no surprise for lenders with 100% of risk experts surveyed in our latest Risk Radar Report stating it’s likely or very likely that customers will experience increased levels of hardship and defaults in the next 12 months.

Against the current economic backdrop, there’s a need to assess affordability on a wider scale, including for customers who haven’t historically needed intervention. In previous consumer research we’ve run, 1 in 2 Australians think that credit providers should proactively monitor their financial health to help pre-empt hardship. Yet of the experts surveyed in our latest Risk Radar Report,

53% said their organisation can’t reliably identify a customer is in financial stress until they miss a payment.

Missing a payment is not the only way for lenders to identify if someone is in financial stress. There are several triggers including a loss or drop in income, greater reliance on savings, a shift in spending to high priority items, and an appetite for high-cost loans for example. Additionally, it’s important for lenders to be able to see all financial products a customer has across different financial institutions, as a customer may look healthy in one portfolio but looks different in another portfolio. Leveraging credit bureau data triggers, and automated income and expense categorisation from transaction data for example, lenders can enhance monitoring and early warning systems to detect changes and spot customer vulnerability faster.

Additionally, by leveraging a broader range of data sources, such as what is available with Open Banking, lenders can significantly improve the accuracy of their creditworthiness and affordability assessments, as well as identify at-risk customers faster.

To be able to take large volumes of customers’ specific circumstances, needs and preferences into account, lenders need automated decisioning technologies that can create a single view of the customer in near real time. Additionally automated decisioning opens the door for personalised contact strategies and the ability to offer multiple channels of support, including self-service options that allow people to set up repayment plans based on the same parameters that would be used in a call centre.

Leveraging technology is key to keeping both lenders and borrowers protected. Automation, data and analytics, and decisioning helps lenders to fully understand a customer’s current circumstances, needs and preferences; enables lenders to proactively monitor their customer’s financial health; and allows them to deliver personalised treatment plans quickly and at scale, as well as reach customers on their terms. This gives every customer the support they need, whether they’re in the recovery process already, or better yet, to help them avoid it in the first place.

To learn more about how we can help, please get in touch with us using the form below.