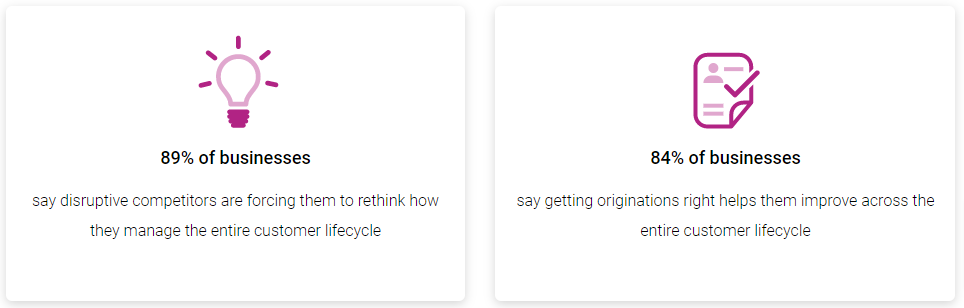

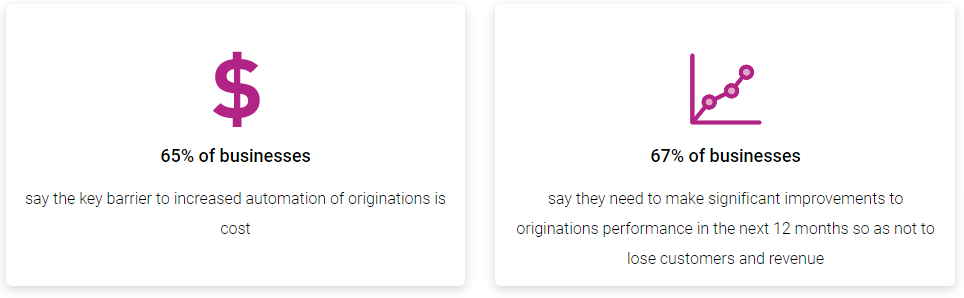

Digital disruption is accelerating the pace of credit decision making, expanding understanding of borrower behaviour and creating new opportunities to enhance the customer experience. Our Optimising Originations research reveals digital disruption is the “new normal” and organisations are challenged by customers, compliance as well as by competitors, whilst focused on driving cost reduction and operational efficiency. Open Data and Open Banking are likely accelerating the need to transform across the customer lifecycle, with originations being the starting point. Businesses identify many shortcomings in their current originations processes and can readily identify areas and key performance indicators (KPIs) needing improvement.

There is a sense of urgency in plans to overhaul originations and a need for practical advice on how to best enhance originations in order to positively impact the whole customer lifecycle. Although originations teams vary in their approaches, they are unified by an appetite to evolve. Access to data and automation emerge as cornerstones of improvement ambitions, alongside a recognition that skills, culture and innovation also play a key role in driving originations agility. This ultimately propels customer acquisition to become the benchmark for other parts of the customer lifecycle and business.