Thriday, a financial management platform for SMEs, has collaborated with Experian to revolutionise financial administration for businesses. Thriday’s unique product automates banking, accounting, and tax for small businesses, helping them save time and costs. The integration of Experian Look Who’s Charging’s technology, which enriches and automatically categorises bank transactions in real-time, has enabled Thriday to offer its customers a more accurate and faster bookkeeping service than human labour. By charging users just $29.95 a month, Thriday has slashed the costs of financial administration for businesses while also saving them six hours of precious time each week.

See full story >Overview: ANZ transforms its retail credit capabilities

ANZ’s triumph with Experian PowerCurve Collections unleashes efficiency & customer-centric benefits

ANZ transformed its Retail Credit capabilities, becoming the first global adopter of Experian PowerCurve Collections. One specific area of overhaul was automated funds transfers for customers in arrears. ANZ faced challenges with manual inefficiencies and data limitations. PowerCurve Collections offered end-to-end automation, enabling complex configurations based on account, customer, and group-level data. This resulted in increased transfer volumes, process transparency, and accuracy. ANZ capitalised on substantial funds transfers opportunities, reduced operational activity, improved arrears, reduced collections provisions and elevating the customer experience.

Challenge overview

Under the old Collections infrastructure at ANZ, any form of automation was heavily reliant on the use of macros and manual processes and checks. In the case of funds transfer, a macro was used to scrape the information from the source system for information relating to the deposit and loan product. This application assesses approximately 3,000 instalment personal loan accounts in a run (~120,000 in Collections at any one point). Prior to Experian PowerCurve, ANZ did not have a solution for Mortgages (unlike Personal Loans). It relied on Operators to manually complete the process on behalf of customers. There were four major flaws identified:

- Due to the time it takes to scrape information for each account, the overall population was quite limited to high risk and high delinquent accounts.

- The process was heavily resource intensive, as each potential funds transfer was manually reviewed and processed by an Operator.

- Due to accounts being manually reviewed by Operators, the possibility of discretion and judgement meant there was an inconsistency in the rules being applied.

- The data being scraped from the source system was limited to 14 fields. Any enhancement to the macro, to get further data points, was quite onerous and challenging.

Australia and New Zealand Banking Group (ANZ) is one of Australia’s largest banks. ANZ employs more than 39,000 people and provides banking and financial products and services to over 8.5 million retail and business customers. The bank operates across close to 30 markets.

| Industry: | Financial Services |

Solution overview

First global adopter of Experian PowerCurve Collection

ANZ saw several exciting opportunities to rethink their collections process, at a customer level, by being the first global adopter of Experian PowerCurve Collections. ANZ took the time to understand the use and functionality of PowerCurve Collections as an out of the box solution then looked to maximise the value without significant customisation.

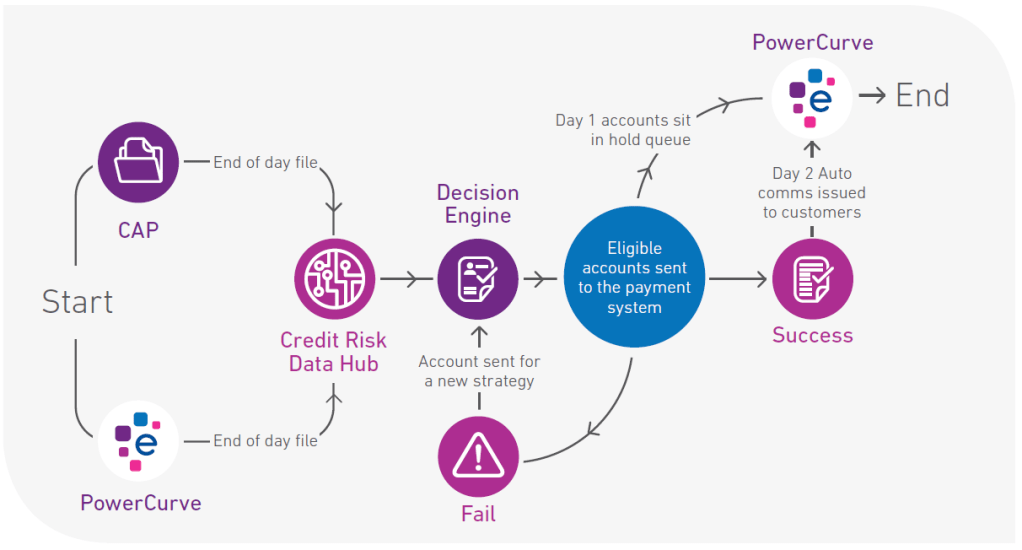

Due to the vast amount of information being consumed within ANZ’s Credit Risk Data Hub (CRDH), PowerCurve Collections allowed users to create a fully automated end-to-end strategy that not only meant an increase in transferred volumes, but due to the richness and accuracy of the data, a more transparent and accurate process. There were four significant benefits with this new design:

- Enables the development of strategies using account, customer, and group level data, allowing for complex configurations that directly inform the decision engine (PowerCurve Customer Management) and allow the strategy to flow seamlessly end-to-end.

- The process, from source data acquisition to eligibility assessments to file processing and customer notifications, is fully automated without the need for manual intervention or additional resource requirements.

- The full portfolio is assessed for funds transfer opportunities, enhancing the chance to reduce delinquency on these accounts.

- Allows for greater opportunities in the future as strategies can be refined and enhanced due to data availability.

Figure 1.0 – Personal Loans – Offset / MPP process

Unlocked benefits

For ANZ, several key benefits have been unlocked using PowerCurve.

For their Personal Loans portfolio, ANZ has seen:

- Accounts less than 30 days – A 102% increase in identifying customers (less than 30 days) that can have a funds transfer of $186 on average across a daily arrears balance of $2.1m (97% increase).

- Accounts greater than 30 days – A 127% increase in identifying accounts with an after daily transfer of $356 on average across a daily arrears balance of $446k (118% increase).

For their Home Loan portfolio, ANZ has seen:

- Accounts less than 30 days – A 356% increase in identifying customers (less than 30 days) that can have a funds transfer of $747 on average across a monthly arrears balance of $282m (251% increase).

- Accounts greater than 30 days – A 7% increase in identified accounts with an after daily transfer of $1,650 on average across a monthly arrears balance of $72m.

This has resulted in a 5% decrease in the 1-29 day arrears bucket for mortgages, 86% of customers remain current 30 days post the transfer.

Not only does this process provide a way to ensure operational activity is minimised, this process also improves associated arrears reporting by identifying more accounts to cure, minimises collection provisions by stopping the role through to higher arrears buckets and reduces capital requirements. Finally, there is also a customer benefit by automating the funds transfer that arguably occurs as part of a collections phone call or customer contact.

“You can get the most value from PowerCurve by simply rethinking some of your current processes and integrating them into the collections ecosystem” – Jason Humphrey, Chief Risk Officer at ANZ

- Enhanced efficiency with a significant surge in identifying funds transfer opportunities

- Reduction in arrears and high proportion of customers remaining current 30 days post transfer

- Improved customer experience with automated funds transfers

Would you like more information?

Speak to an expert